FREE INVESTHER 101 BEGINNERS GUIDE

In 20 minutes, you’ll go from ‘I know I should invest but I don’t know how’… to ‘I’m actually investing, I know why, and I know what I’m investing in'.

HOW THIS WORKS

Let’s be real: a lot of us want to invest, but we’re stuck between overthinking, fear, and “idk where to start.” And as a fellow 9–5 corporate baddie, I’m not here to tell you to stop enjoying your life. I’m here to give you a simple, realistic plan so you can

invest confidently without giving up the things you love.

Here’s what we’re not doing

inside InvestHER 101:

No judgment (we didn't learn this in school)

No risky, confusing strategies

No guessing or copying strangers’ portfolios

We work hard enough.

It’s time for our money (including our investments) to finally start working for us.

AT THE END OF THIS CRASH COURSE, YOU'LL BE CLEAR ON:

What investing really means and why it matters

What investing really means and why it matters

We hear it online, we see it in the news. But no one has broken it down for real. Until now.

What type of accounts you already have

What type of accounts you already have

Our jobs do more than just pay us. Learn how to truly maximize your employer!

What type of investments are best for beginners

What type of investments are best for beginners

Trying to understand each and every stock you see will only keep you confused.

What mistakes you must avoid as a newbit

What mistakes you must avoid as a newbit

We don't have money to lose in this economy. So we are starting small & staying consistent.

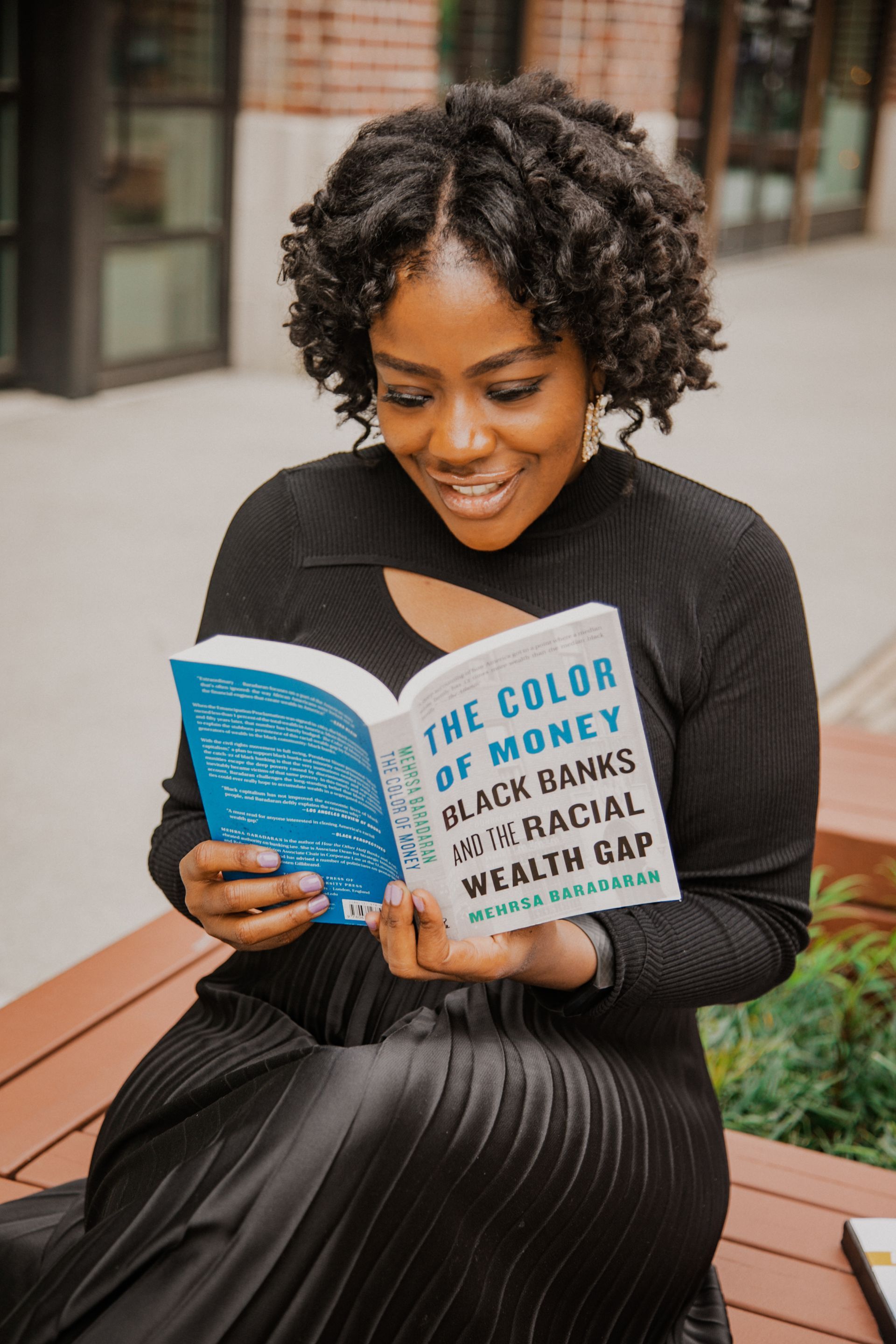

Meet your Host

Meet your Host

Hey, I’m Joshlyn and I am a Money Coach (CFEI), Speaker and Self-Taught Investor who has built a $250,000 investment portfolio, saved 6+ months of living expenses and paid off over $80,000 in student loan debt. I’ve helped over 100 women improve their relationships with money and supported over 300 women in purchasing their first homes. I’ve also partnered with companies such as Fundrise, Marcus by Goldman Sachs, and Chase Bank just to name a few.

But this wasn’t always my story. Statistics show that 73% of millennials are living paycheck to paycheck and I was a part of that number for a long time. It was a combination of experiences – such as being laid off twice, quitting a toxic job with no real income plan, and struggling to purchase my first home – that taught me the importance of financial independence. Statistics also show that black women earn 63 cents for every dollar earned by white men, and I envision a world where women never have to be at the mercy of an employer (or a limited salary) ever again.

Today, as the founder of Maximized Money, I am normalizing a world where women have options and freedom. Freedom to be wherever and do whatever by using the income they earn now to create the life they’ve always desired (and can afford).

WATCH THE INVESTHER 101 COURSE