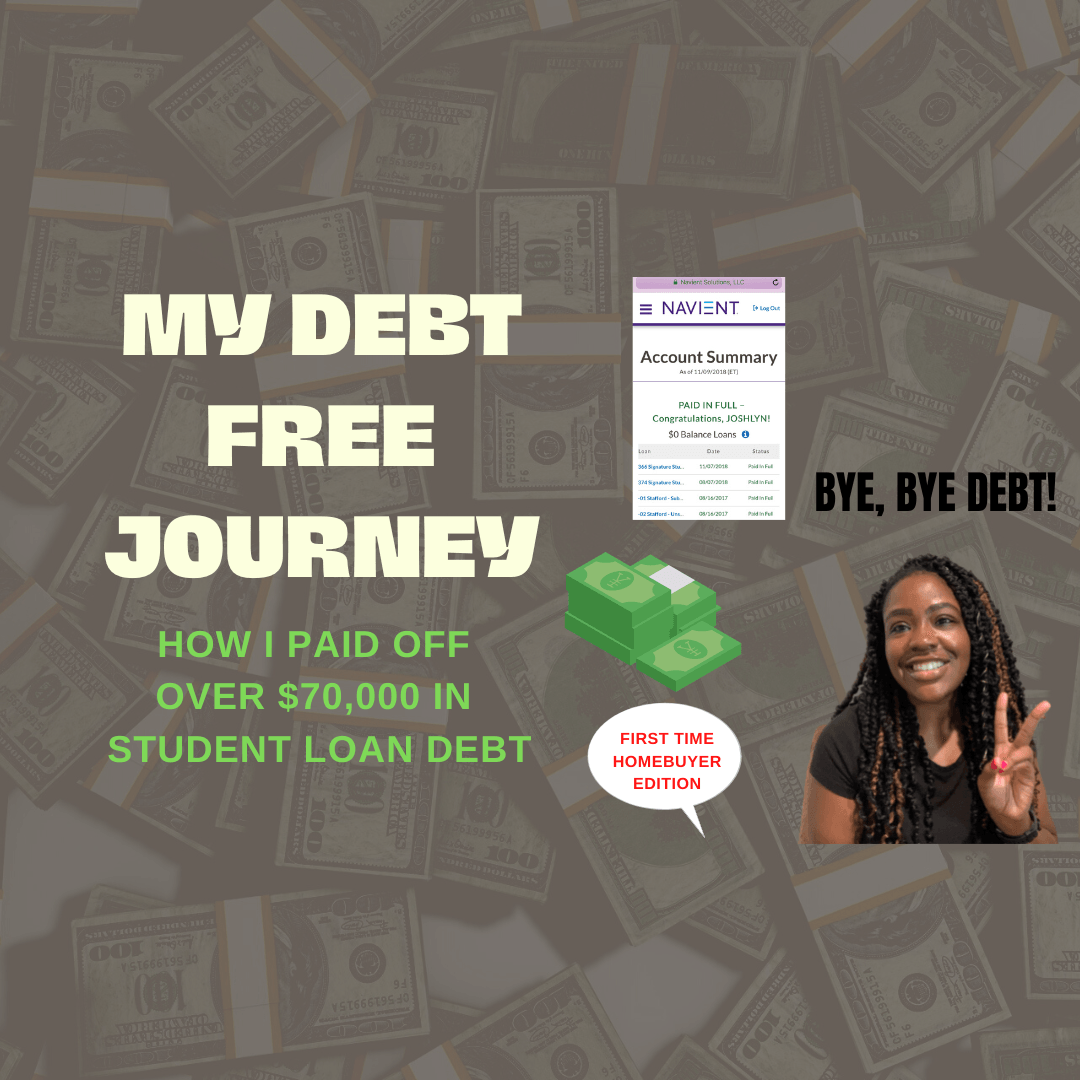

#20: My Debt Free Journey | Student Loans edition

I didn’t realize how important my debt free journey was until I attempted to buy my first home. Whew, what a time. My home buying journey started years ago in a completely different city and under different circumstances.

At that time, I was making decent money, paying off my student loans (making the bare minimum payment, sometimes more haha), finishing up my car notes, and saving the rest. I felt like the next ideal step was to buy a house. But I quickly learned that my finances weren’t as strong as I thought they were.

Once I met my agent, she introduced me to a lender who helped me get pre-approved. When I saw the amount I was pre-approved for, I was like uh oh. This is kinda slimmmm. But I decided to start looking for houses anyway. Fast forward to 3 months later, I had seen maybe 2-3 homes that were worth an offer – but ultimately did not get.

That’s when my agent and lender encouraged me to take a break to pay off some debt so I can improve my debt-to-income ratio, which would ultimately increase my pre-approval amount. At first, I was going to just pay off a little – but I’ve never been the type to half a** stuff. So that’s when my debt free journey began.

In this video, I tell my whole story and offer some tips to help you on your debt-free journey. Let me know if you have any questions!

Resources:

Biggest mistake I made in my homebuying journey: https://youtu.be/Yn-LsYujGtA

First time homebuyer loans:

https://www.maximizedmoney.com/first-time-homebuyer-loans

Instagram (we have lots of fun over here):

https://www.instagram.com/maximized.money

Podcast: Real Estate Prep:

https://www.maximizedmoney.com/episodes (available on all streaming platforms)

Ready to find the right real estate agent for you? Download my free checklist for questions to ask:

https://www.maximizedmoney.com/homebuyers-checklist

Want to get your finances together for your big home purchase? Join my free Homebuyer Goals Challenge:

RECENT EPISODES